The Significance Of Regularly Evaluating And Changing Your Wealth Monitoring Plan Can Not Be Overstated

Posted By-Axelsen Aycock

Consistently evaluating and changing your wide range management plan is a fundamental element of monetary prudence. By staying positive and mindful to your monetary approaches, you can make certain that your investments are lined up with your goals and adjust to altering market conditions. This ongoing procedure not only safeguards your economic future but also improves the possibility for growth and stability. Keep in mind, a well-structured wide range monitoring plan is not static; it needs constant monitoring and changes to browse the complexities of the economic landscape successfully.

Benefits of Regular Testimonials

Consistently examining your riches monitoring strategy provides useful insights and chances for optimization. By conducting periodic testimonials, you can ensure that your economic goals continue to be lined up with your existing life situations. These reviews permit you to track the efficiency of your financial investments, assess the efficiency of your cost savings and spending techniques, and make necessary changes to stay on course.

With normal evaluations, you can recognize locations where your portfolio may require rebalancing to preserve diversification and handle danger efficiently. Furthermore, you can take advantage of brand-new financial investment chances that may emerge, making sure that your wide range continues to expand and work for you. By staying actively involved with your wealth monitoring plan, you empower on your own to make educated choices and adjust to modifications in the economic landscape.

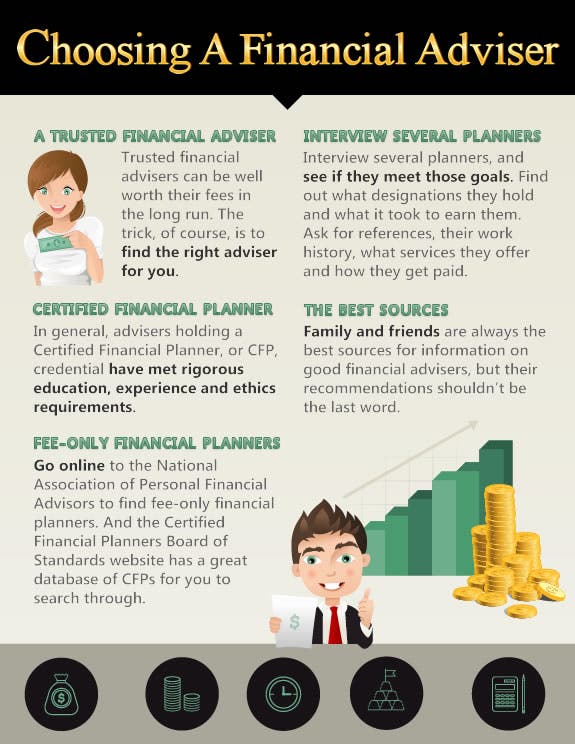

Moreover, normal reviews provide a platform for interaction with your financial advisor, cultivating a collaborative connection improved count on and transparency. This continuous dialogue allows you to address any worries, check out ingenious strategies, and inevitably improve the efficiency and strength of your wealth administration strategy.

Threats of Neglecting Adjustments

To keep the effectiveness of your riches management plan, ignoring needed modifications can reveal you to substantial risks. As your monetary circumstance advances, stopping working to examine and change your riches administration plan consistently can cause missed out on chances or raised direct exposure to market volatility. Ignoring modifications may result in your portfolio becoming misaligned with your current monetary goals and take the chance of tolerance. https://www.ibtimes.co.uk/husband-financial-planner-over-400k-debt-confused-why-his-wife-wont-combine-finances-1724568 can leave you prone to unforeseen market recessions or inflation threats, potentially threatening your long-lasting economic safety and security.

In addition, stopping working to update your plan in reaction to changes in tax regulations or policies may lead to missed tax-saving chances or conformity concerns.

Techniques for Continuous Success

Consistently examining and readjusting your riches monitoring plan is critical for long-term success and financial protection. To make certain continuous success, routinely examine your monetary goals, danger resistance, and investment performance. Reviewing your strategy permits you to adapt to life adjustments, market changes, and brand-new possibilities successfully.

One key approach for maintaining success is diversity. By spreading your financial investments across various property classes, markets, and geographical regions, you can minimize risk and improve returns in time. Furthermore, consider rebalancing your profile regularly to realign with your target possession allocation.

An additional vital element is staying informed and seeking professional advice when required. Maintaining updated with market fads, tax obligation regulations, and economic news equips you to make well-informed decisions. Consulting with an economic consultant can supply valuable understandings and experience to optimize your wide range administration strategy.

Finally, regularly checking and tracking your progress is essential. Establish particular standards and consistently review your efficiency against these objectives to remain on track and make necessary modifications. By applying these strategies for continuous success, you can protect your economic future and attain your lasting goals.

click here

To conclude, regularly examining and adjusting your wealth management plan is necessary for staying on track and achieving your monetary goals.

By taking positive steps to enhance your approaches, track your investments, and look for expert suggestions, you can boost your monetary health and be far better planned for market changes.

Don't wait up until it's far too late to make necessary modifications-- focus on the continuous success of your wide range management plan.